These companies are taxed at a rate of 24 Annually. Double Tax Treaties and Withholding Tax Rates Real Property Gains Tax Stamp Duty Sales Tax.

Irs 2019 Tax Tables Tax Table Federal Income Tax Tax Brackets

On the First 5000.

. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25 600000 133650 26 1000000 237650 28 A qualified person defined who is a knowledge worker residing in. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia.

Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share. Inland Revenue Board of Malaysia. With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than MYR 50 million.

Calculations RM Rate TaxRM A. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. Calculations RM Rate Tax RM 0 - 5000.

Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in 2020. The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia. Corporate Income Tax.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Resident companies are taxed at the rate of 24. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25 600000 133650 26 1000000 237650 28 A qualified person defined who is a knowledge worker residing in.

Assessment Year 2019 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income. Its amount is based on the net income companies obtain while exercising their business activity normally during one business year. The current CIT rates are provided in the following table.

Corporate tax rates for companies resident in Malaysia is 24. In Malaysia the Corporate Income tax rate is a tax collected from companies. Legislation to implement the ESR has not yet been.

20182019 Malaysian Tax Booklet 22 Rates of tax 1. Malaysia Non-Residents Income Tax Tables in 2019. What is the Corporate Tax Rate in Malaysia.

However in the case of a resident company the Malaysia corporate tax rate can be applied at 17 or 24 from the yearly income the lower rate of 17 is not applicable to non-resident. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying. Income from RM500001.

The deadline for filing income tax in Malaysia is 30 April 2019 for manual filing and 15 May. Types Of Income. Income Tax Rates and Thresholds Annual Tax Rate.

Rate Business trade or profession Employment Dividends Rents. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person other than a company.

20182019 Malaysian Tax Booklet. They all refer to the tax tables whether in whole or as specific. Companies incorporated in Malaysia with paid-up capital of MYR 25 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on.

However business sectors such as air transport banking insurance and shipping dont fall. Income tax rates. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

20182019 Malaysian Tax Booklet 22 Rates of tax 1. The existing tax exemption for interest earned on wholesale money market funds will cease with effect from 1 January 2019. Malaysia personal allowances and tax thresholds or Malaysia business tax rates.

Are proposed to take effect from January 2019. Malaysia Residents Income Tax Tables in 2019. The standard Malaysia corporate tax rate is of 24 for the financial year of 2019-2020 this rate being applied to both resident companies and to non-resident companies.

On the First 5000 Next 15000. Foreign-source income is exempted from corporation tax. Corporate tax highlights.

Rate The standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie. Tax Rates for Individual. The carryback of losses is not permitted.

On the First 5000. The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million.

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

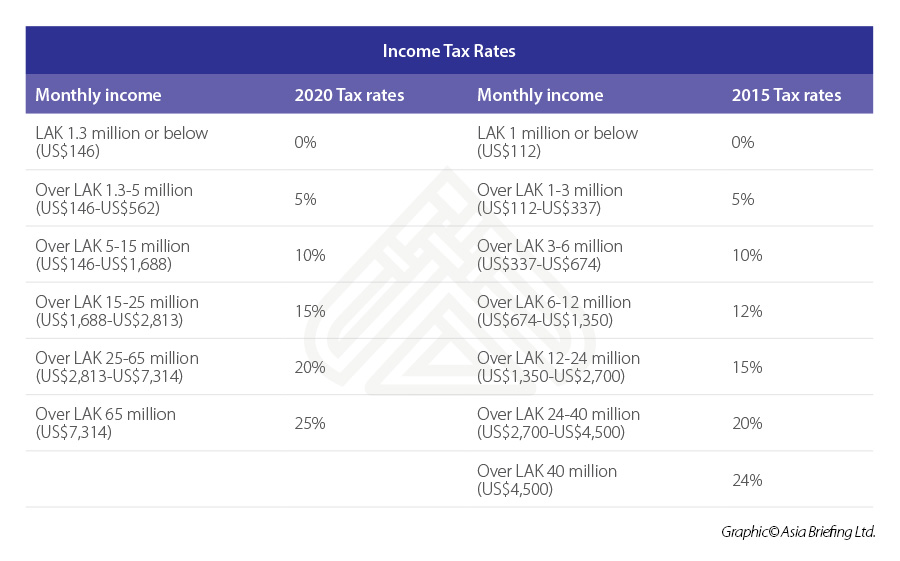

Tax Identification Numbers In Laos Compliance By June 2021

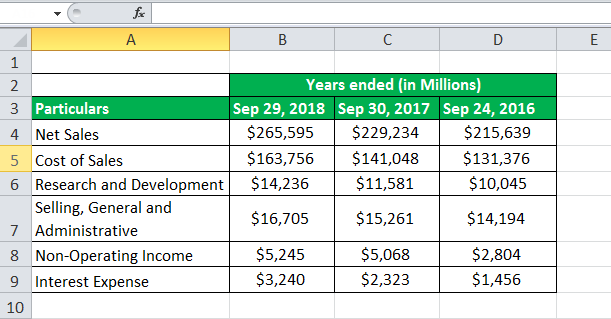

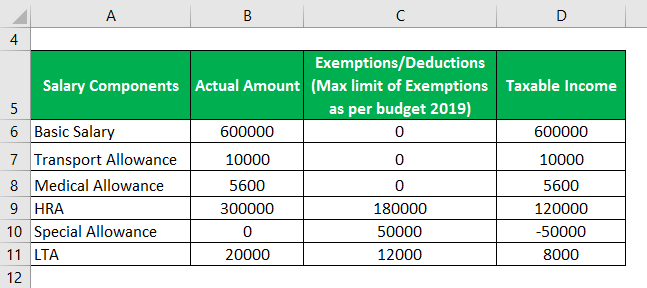

How To Calculate Income Tax In Excel

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Taxable Income Formula Examples How To Calculate Taxable Income

Malaysia Tax Revenue 1980 2022 Ceic Data

How Much Does A Small Business Pay In Taxes

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Sources Of Revenue For The States Insightsias

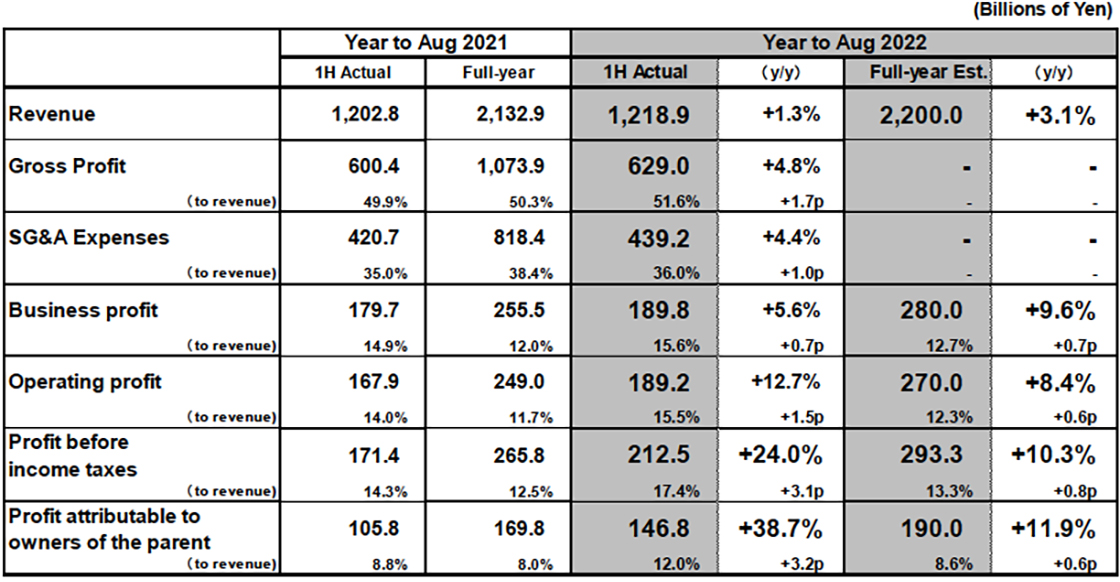

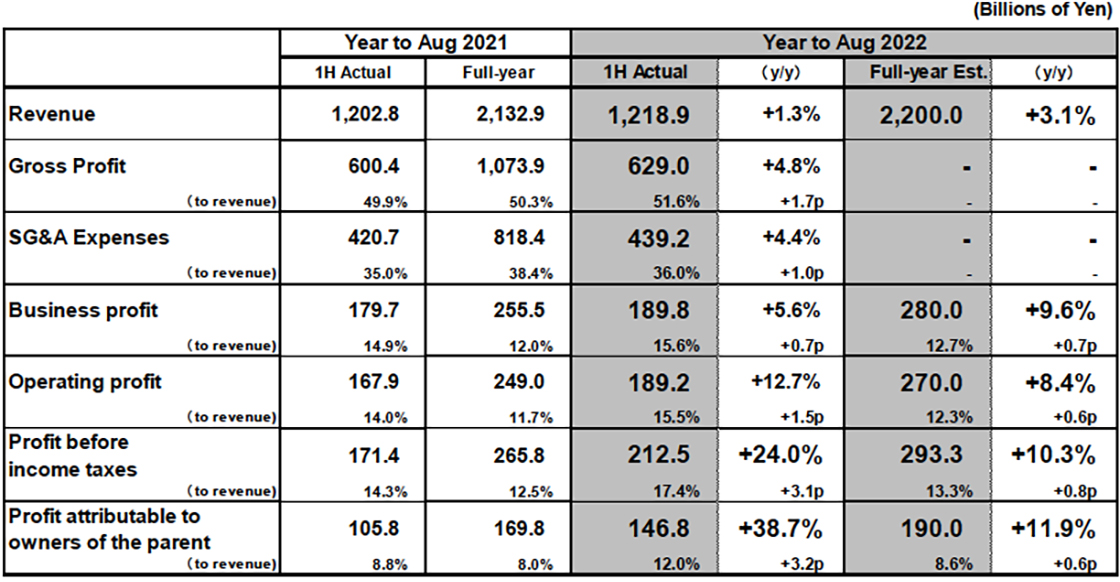

Results Summary Fast Retailing Co Ltd

Awesome Depreciation Tax Shield In Hire Purchase Is Claimed By In 2022 Hire Purchase Hiring Tax

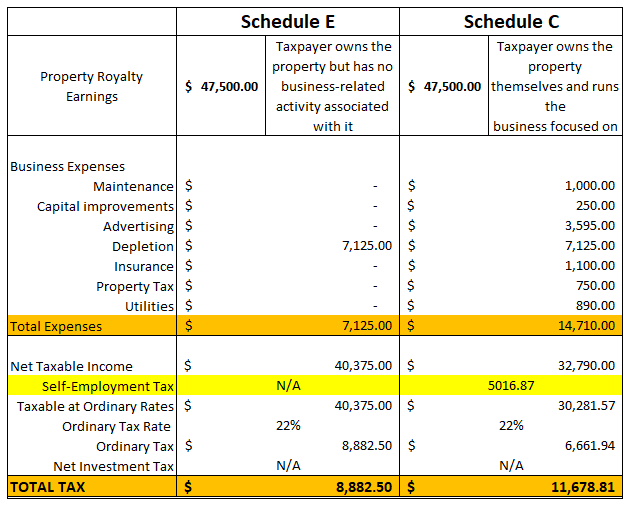

Royalty Income Taxes For 2020 With Filling Procedures Taxhub

Taxable Income Formula Calculator Examples With Excel Template

10 Things To Know For Filing Income Tax In 2019 Mypf My

Individual Income Tax In Malaysia For Expatriates

Taxplanning Tax Measures Announced During The Mco The Edge Markets

/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)